ESG risks

Key non-financial risks

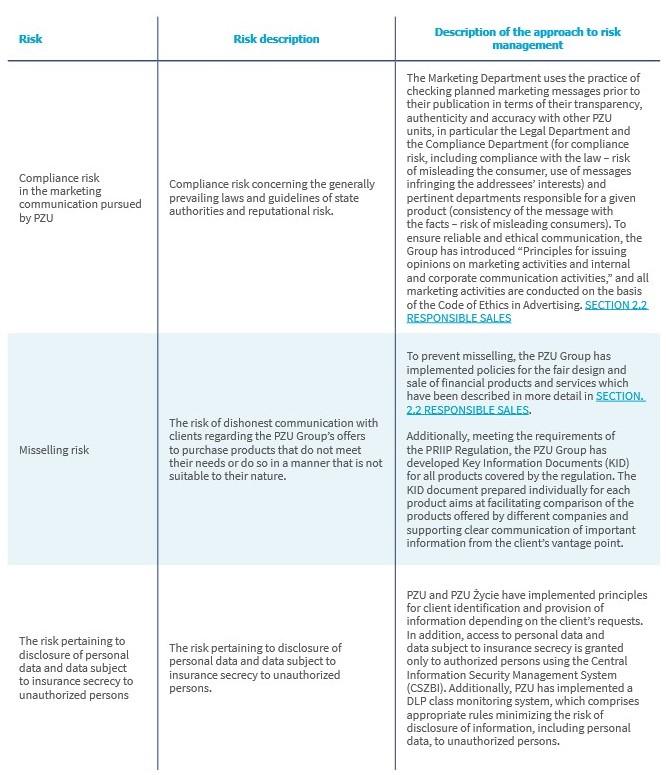

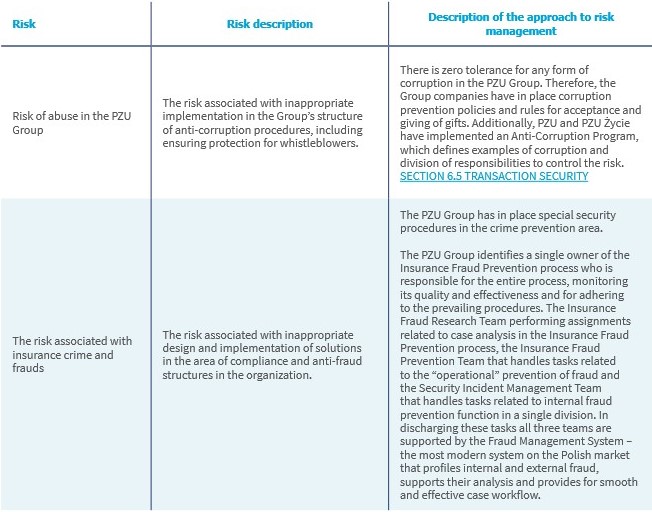

From the perspective of the impact on issues related to social, employee, environmental, human rights and prevention of corruption, compliance risk and some operational risk are of special importance. In addition, the PZU Group identifies environmental risk in the process of financing entities.

The PZU Group has implemented an operational risk management system under which it prevents operational risk incidents and reduces operational losses. The operational risk management principles and structure in PZU are based on the adopted operational risk management policy. Operational risk is controlled on multiple levels in the organization. Supervision over the operational risk management system is exercised by an independent, dedicated unit within the Risk Department structure.

The key tool used to monitor operational risk is the key risk indicator system, covering areas with special exposure to operational risk. The indicators are subject to regular reviews: at least once a year.

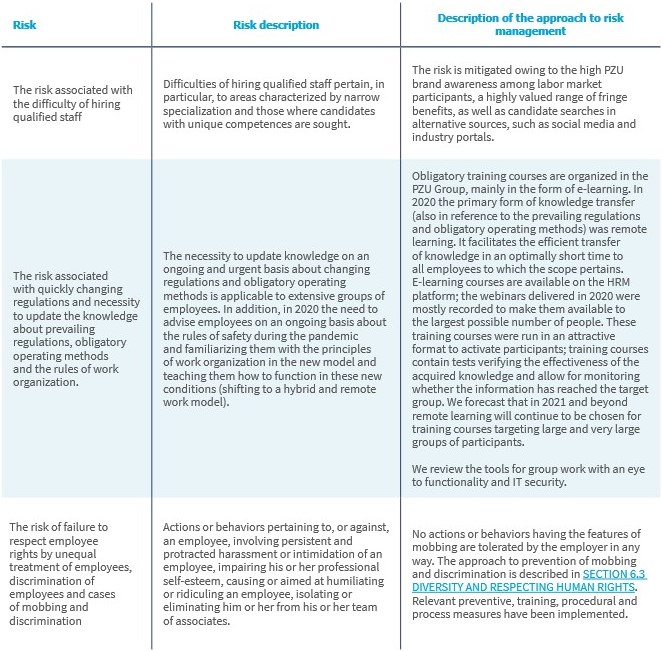

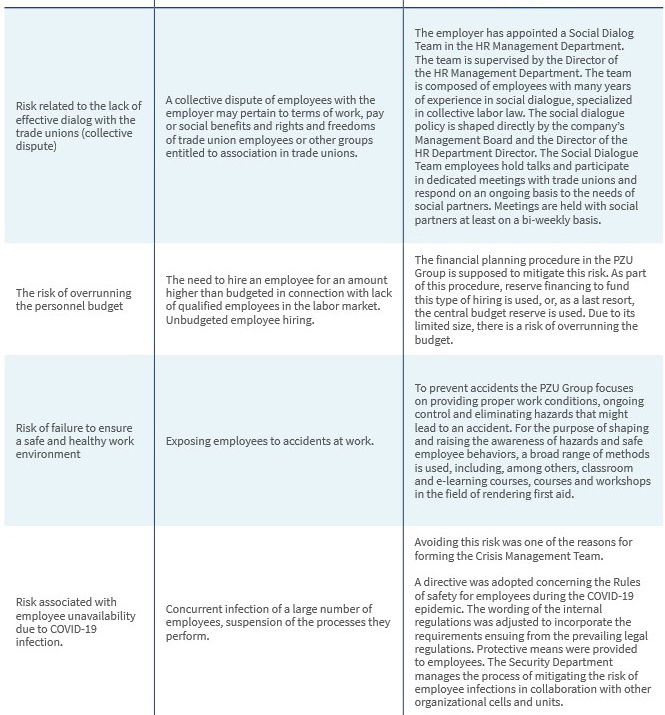

As part of compliance risk and operational risk, employee, environmental, social, ethical, including interactions with clients and prevention of corruption issues have been identified. Below is a list of key issues.

Employees and respecting human rights

Products and client relations

Corruption prevention area

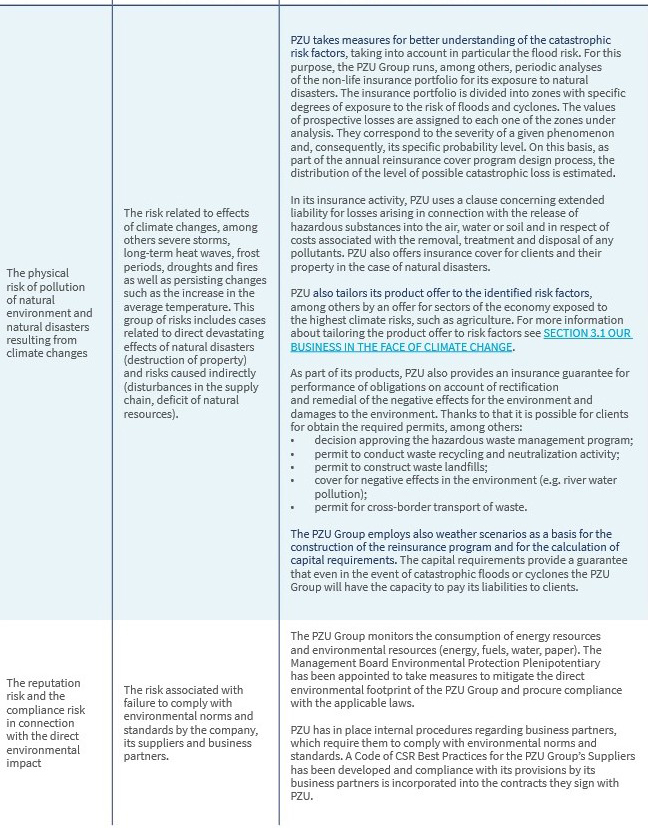

Protection of natural environment and climate

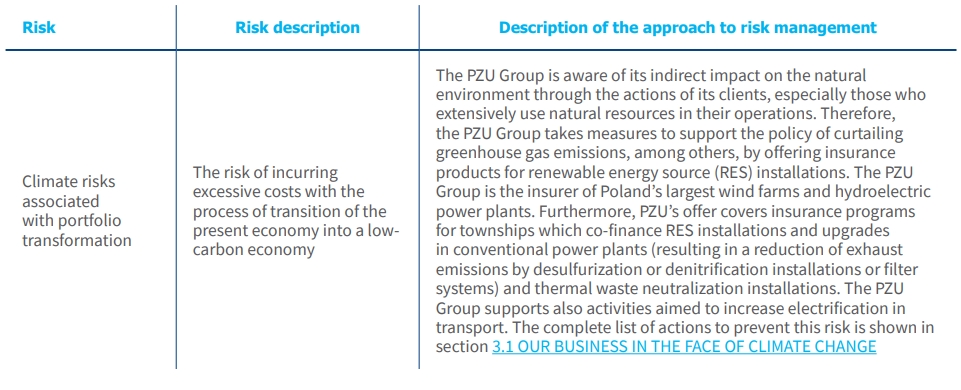

The extent to which chances and risks related to the climate change will affect the insurance industry depends on a specific product or offered services and the planned investment. The processes of preparation of policies, pricings, reinsurance strategies, as well as the banking and investment activities take into account climate risks based on the short-term perspective. PZU can perceive the potential adverse influence of frequent and increasingly more severe weather phenomena on the financial results. Therefore PZU incorporates the possibility of catastrophic phenomena in the economic strategies and models it prepares. The goal is to enhance the degree of resistance to the materialization of possible scenarios.

The probability that the risk related to the global economy transition into a low-carbon one (transition risk) will materialize is much higher than the probability that the most extreme physical risk related to the climate change will materialize. PZU takes measures aimed to limit the probability that the transition-related risk will materialize through investments for low-carbon economy. On the other hand, the PZU Group is aware that the materialization of the most extreme physical risk would constitute a threat to the whole insurance sector. The effects of escalating climate changes might contribute to the materialization of risks for which insurance may become unaffordable.

In 2020, initiatives were undertaken to improve the identification, measurement, assessment and monitoring of the risks associated with sustainable development, in particular climate change. The main risks in this area, transition and physical risks, are managed as part of the individual risk categories specified below in this section in the table entitled Risk categories in the Group. Having regard for the rising materiality of sustainable development and climate change and their significance to the financial industry, as part of the subsequent work defined in the Sustainable Development Strategy, the PZU Group will strive to incorporate even more comprehensively climate-related factors in processes used to manage the various categories of risk.

Climate change research

The PZU Group conducts regular stress tests and sensitivity analyses under its annual analysis of own risk and solvency assessment (ORSA) and stress tests consistent with the requirements of the regulatory authority. Under ORSA, the sensitivity analyses for PZU cover stress scenarios affecting assets and liabilities. The stress tests selected for execution as part of this assessment cover the major areas of activity and the PZU Group’s risk profile. They correspond to the assessment of the most important risks; in particular, the short-term impact of extreme weather-related phenomena (catastrophic losses) and the impact of the growth of the loss ratio on the PZU Group’s capital condition are regularly analyzed.

In addition, PZU as the parent company regularly runs a process to analyze risks and identify key risks in conjunction with the processes of managing the various categories of risk specified in this section in the table entitled Categories of risk in the Group. All of the risks identified during this process are assessed from the perspective of frequency and severity of materialization (taking into account financial severity and reputation impact). In particular, risks related to climate change are subject to risk in terms of physical risks and transition risks. This process facilitates risk analysis in the medium-term and identification and assessment of emerging risks. This analysis is updated at least once a year.

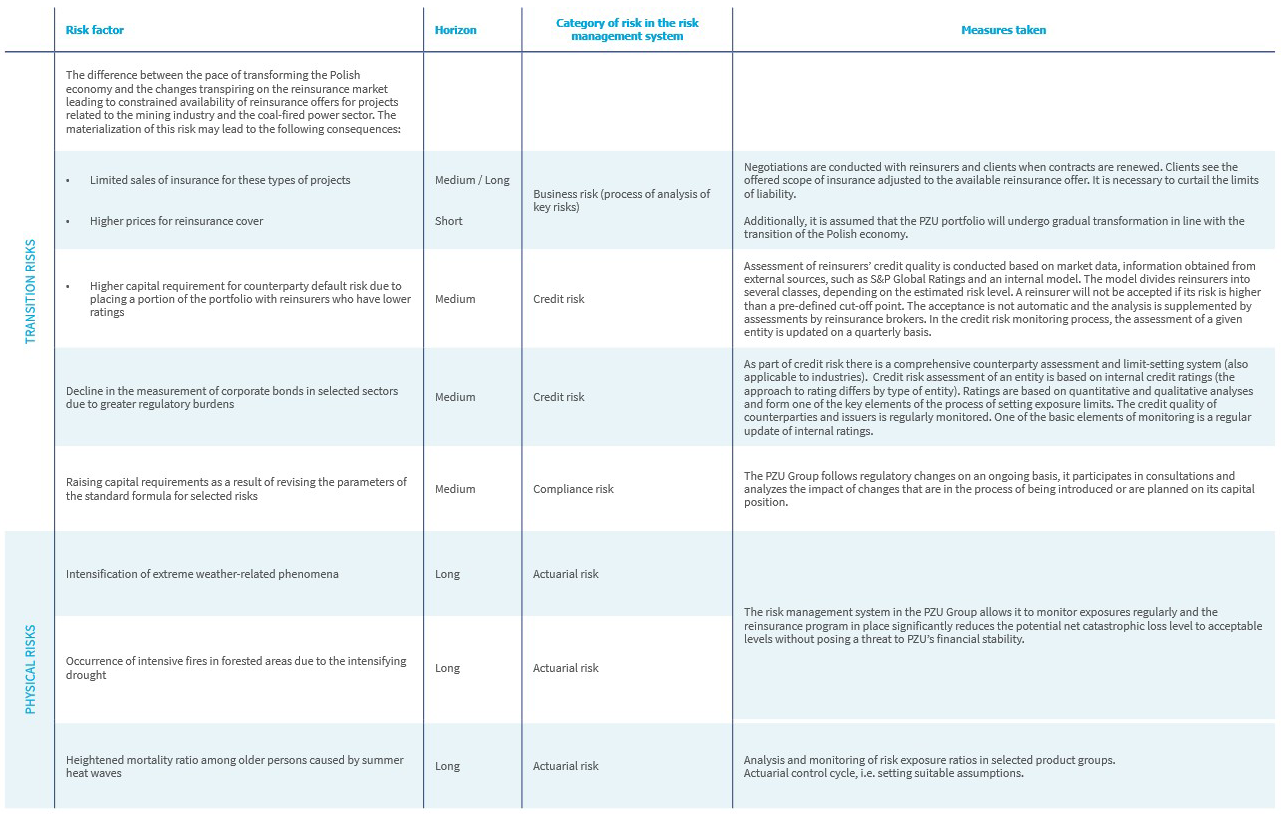

The following climate-related risk factors that may affect the PZU Group’s business model and financial results have been identified as a result of these analyses:

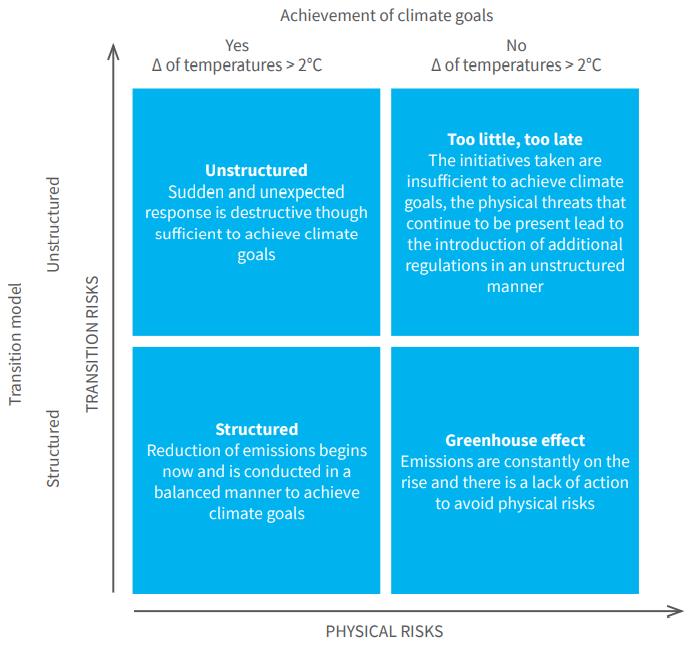

The risk factors itemized in the table above have been analyzed under 2 scenarios for which the starting point is the structure of the scenarios proposed by The Network of Central Banks and Supervisors for Greening the Financial System (NGFS).

During the current phase of analyzing climate risks the PZU Group studied:

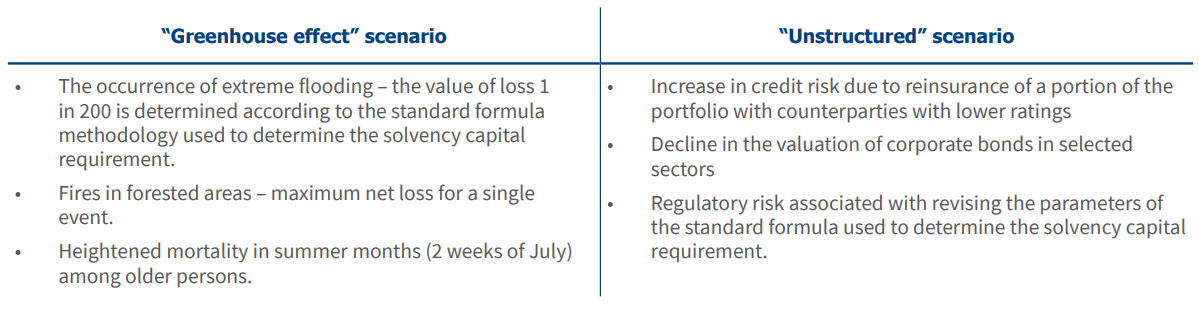

- The “Greenhouse effect” scenario in which physical risks play the main role, which in a simplified approach involve the assumption of a zero impact exerted by transition risks;

- “Unstructured” scenario in which transition risks play the main role, which in a simplified approach involve the assumption of a zero impact exerted by physical risks.

Structure of scenarios

Source: A call for action; Climate change as a source of financial risk, April 2019

The below assumptions and risk factors were taken into account:

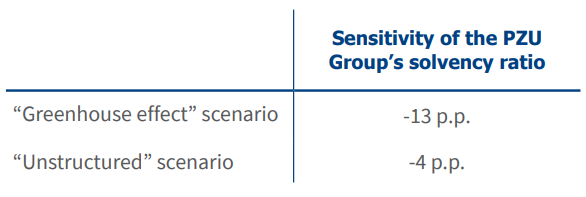

The results of this analysis demonstrated that the PZU Group’s solvency would not be at risk. The regulatory requirements and the assumptions concerning the internal limit system are satisfied in both scenarios. The table below depicts the sensitivity of the PZU Group’s solvency ratio estimated on the basis of financial plans at yearend 2021.

Classifying the occurrence of extreme flooding as a physical risk is the most severe factor. This is a long-term risk associated with temperatures rising more than 2°C. Annual renewals of contracts and analysis of current data and forecasts coupled with the selection of the appropriate reinsurance program make it possible to reduce considerably the possible impact this risk can exert on the PZU Group.

The most severe transition risk is the regulatory risk associated with a change in the parameters used to calculate the submodule for the natural catastrophe risk.

Responsible investments

Governance policies and systems in the PZU Group [Accounting Act]

[GRI 103-2], [GRI 103-3]

The investment decisions made by TFI PZU are preceded by a process based on an analysis of companies perceived as potential investment targets. In addition to an evaluation of the financial standing of companies and prospects for an increase in their value, every decision also contains an assessment of investment risk, environmental impact and corporate governance principles constituting selected aspects of the socially responsible investing process. This approach enables TFI PZU to develop an in-depth and detailed understanding of the target company’s situation, which translates into fully awareness-based and responsible investment decisions.

In their work, members of the TFI PZU team:

- are guided by stringent ethical standards when making investment decisions;

- stimulate the use of corporate governance principles, in particular those that advance transparency, equal treatment of shareholders, independent oversight and the responsibility of shareholders and members of management and supervisory bodies in target companies;

- expect companies whose shares are included or considered for inclusion in their mutual fund portfolios or investment portfolios to apply corporate governance principles broadly accepted on the market, especially those contained in best practices of WSE-listed companies, which seek to strengthen the transparency of listed companies, increase the quality of their communication with investors and enhance the protection of shareholder rights, also in matters not governed by the law.

TFI PZU, bearing in mind the interests of participants in the mutual funds it manages and clients to whom it provides portfolio management services, is guided by its “Strategy for exercising voting rights”. The company’s fundamental duties ensuing from its strategy are as follows:

- monitoring material events in the companies identified in the strategy;

- ensuring that voting rights are exercised in accordance with the investment objectives and investment policy of the respective fund;

- preventing conflicts of interest following from exercising voting rights and managing companies.

The Management Company actively participates in the corporate governance development process in its portfolio companies by participating in their shareholder meetings and pursuing the goal of protection and creation of investment value for fund participants and its clients. Bearing in mind the remaining provisions of the strategy, TFI PZU espouses the principle that it strives to participate and actively vote in all shareholder meetings of companies in which it has, on behalf of its funds or clients, the right to exercise more than 5% of the total number of votes.

TFI PZU has adopted principles that guide its choices when voting at shareholder meetings of companies included in its mutual fund portfolios or investment portfolios. The rules contemplate among others active voting on matters related to social and environmental issues as well as corporate governance issues. Additionally, they include provisions encouraging stringent corporate governance standards, in particular those that advance transparency, equal treatment of shareholders, independent oversight and the responsibility of shareholders and members of corporate authorities.

The Code of Best Practices of Institutional Investors prepared and approved by the Chamber of Fund and Asset Management has been in force in TFI PZU since 2006. For TFI PZU, the Code provides a great deal of support in defining the rules, moral and ethical standards and due diligence levels in the company’s relationships with other institutional investors, clients and issuers of financial instruments. The adoption of this code also confirms the application of best investment practices in TFI PZU.

On 22 December 2014, the Management Board of TFI PZU adopted a resolution to adopt the “Corporate governance rules for regulated institutions” issued by the Polish Financial Supervision Authority (KNF) in which the Management Board declared its readiness and will to abide by these rules to the objectively broadest possible extent, taking into account the principle of proportionality resulting from the scale, nature of business and specific characteristics of TFI PZU. The rules are a collection of standards that define the internal and external relations of regulated institutions, including their relations with shareholders and customers, their organization, the functioning of internal oversight and key internal systems and functions as well as the governing bodies and the rules for their cooperation. According to the contents of this document, TFI PZU provides on its website information on the application or non-application of specific principles addressed to the Management Board and Supervisory Board.

TFI PZU employs managers holding the CFA designation who are bound by a code of ethics and standards of professional conduct. In their professional contacts with the public, clients, prospective clients, employers, employees, colleagues in the investment profession, and other participants in the global capital markets, members of the CFA Institute act with integrity, competence, diligence, respect and in an ethical manner. They also promote the fairness and vibrance of capital markets to obtain the greatest social benefits.

TFI PZU also employs investment advisers who are guided in their work by the standards laid down in the Professional Ethics Principles for Brokers and Advisers. Ordinary members of the Association of Brokers and Advisers undertake to act in accordance with the law and the principles of fair trading, heed the interests of their clients, act honestly and behave in a dignified, trustworthy, ethical and professional manner in their professional dealings, especially with clients, employers, colleagues and other brokers and advisers.

BEST PRACTICE

As of March 2020 these rules include environmental, social and governance issues. In accordance with them, TFI PZU:

- will actively vote on matters related to social and environmental issues as well as governance issues;

- will endorse the application of high corporate governance standards, in particular those that advance transparency, equal treatment of shareholders, independent oversight and the responsibility of shareholders and members of corporate authorities;

- will endorse actions for issuers to adopt, implement and publish governance and ethical principles, standards and procedures spanning the issuer’s management board, supervisory board and employees.

These practices serve the interests of members of funds and portfolio clients, grow the value of investments while simultaneously respecting environmental and CSR issues and building high standards of corporate governance.

TFI PZU, bearing in mind the interests of participants in the funds it manages is guided by the “Exposure policy of mutual funds managed by TFI PZU SA to companies listed on the regulated market”. This policy was adopted in April 2020.

The policy describes how shareholders’ exposure to companies listed on the regulated market is taken into account in the fund’s investment strategy.

Actions related to funds’ exposure to issuers’ equities in which an investment has been made include, among others, monitoring issuers in terms of the investment risk with an eye to social and environmental impact and the corporate governance principles followed constituting selected aspects of the socially responsible investing process.

The research process is conducted in such a way so as to facilitate deliberate and responsible investment decision-making.

These practices serve the interests of members of funds, grow the value of investments while simultaneously respecting environmental and CSR issues and building corporate governance. The purpose of this action is ensuring that investment decisions are made in accordance with the investment objectives and investment policy of the respective funds.