Navigation Map

- strategy (insurance, health, investments, finances);

- sustainable development (sales, employees, social responsibility, natural environment and ethics).

PRACTICES

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

List of GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

GRIs

In the Chapter

Operating model

GRIs

- About the report

- Results

- Comment on the financial results for 2020

- Major factors contributing to the consolidated financial result

- PZU Group’s income

- PZU Group’s claims paid and technical provisions

- PZU Group’s acquisition and administrative expenses

- Drivers and atypical events affecting the results

- PZU Group’s asset and liability structure

- Contribution made by the market segments to the consolidated result

- Issuer’s financial results – PZU (PAS)

- Impact of the COVID-19 pandemic on the PZU Group’s results

- Business strategy (2017-2020)

- CSR strategy(2017-2020)

- Supplementary information and notes

- 1. Introduction

- 2. Composition of PZU Group

- 3. Shareholder structure

- 4. Composition of the Management Board, Supervisory Board and PZU Group Directors

- 5. Key accounting policies, key estimates and judgments

- 5.1 Impact of the COVID-19 pandemic on the estimates and assumptions

- 5.2 Changes in accounting policies and estimates, errors from previous years

- 5.3 Amendments to the applied IFRS

- 5.4 Explanation of differences between the 2019 annual consolidated financial statements and these consolidated financial statements

- 5.5 Consolidation principles

- 5.6 Measurement of transactions and balances denominated in foreign currencies and FX rates used

- 5.7 Purchase method

- 5.8 Classification of insurance contracts in accordance with IFRS 4

- 6. Segment reporting

- 7. Risk management

- 8. Equity management

- 9. Fair value

- 10. Gross written premium

- 11. Fee and commission income

- 12. Interest income calculated using the effective interest rate

- 13. Other net investment income

- 14. Result on derecognition of financial instruments and investments

- 15. Movement in allowances for expected credit losses and impairment losses on financial instruments

- 16. Net movement in fair value of assets and liabilities measured at fair value

- 17. Other operating income

- 18. Claims and movement in technical provisions

- 19. Fee and commission expense

- 20. Interest expenses

- 21. Acquisition costs

- 22. Administrative expenses

- 23. Employee expenses

- 24. Other operating expenses

- 25. Income tax

- 26. Earnings per share

- 27. Goodwill

- 28. Intangible assets

- 29. Other assets

- 30. Deferred acquisition cost

- 31. Property, plant and equipment

- 32. Investment property

- 33. Entities carried by the equity method

- 34. Loan receivables from clients

- 35. Financial derivatives

- 36. Investment financial assets

- 37. Receivables

- 38. Impairment of financial assets

- 39.Cash and cash equivalents

- 40. Equity attributable to equity holders of the parent

- 41. Technical provisions

- 42. Subordinated liabilities

- 43. Liabilities on the issue of own debt securities

- 44. Liabilities to banks

- 45. Liabilities to clients under deposits

- 46. Other liabilities

- 47. Provisions

- 48. Deferred income tax

- 49. Assets and liabilities held for sale

- 50. Lease

- 51. Assets securing receivables, liabilities and contingent liabilities

- 52. Contingent assets and liabilities

- 53. Offsetting financial assets and financial liabilities

- 54. Notes to the consolidated cash flow statement

- 55. Disputes

- 56. Transactions with related entities

- 57. Headcount

- 58. Other information

- Financial data (2019-2020)

- Financial data (2016-2020) Focus on: Results - check the highlights of the year!

- Comment on the financial results for 2020

- Market and business

- External environment

- Business model

- Structure of the Group

- Operating model

- Brand management

- Insurance

- Non-life insurance (PZU, LINK4 and TUW PZUW)

- Life insurance (PZU Życie)

- Insurance (international operations)

- Investments

- Investments (PZU TFI)

- Investments (PTE PZU)

- Health

- Health (health companies)

- Banking and strategic partnerships

- Banking (Bank Pekao, Alior Bank)

- Other operating areas

Focus on: Market and business - check the highlights of the year!

- Capitals (IIRC)

- Strategy and outlook 2021+

- Risk and ethics

- Objective of risk management

- Risk management system

- Risk appetite

- Risk management process

- PZU Group's risk profile

- ESG risks

- Risk vulnerability

- Reinsurance operations

- Capital management

- Ethical foundations of doing business

- Preventing corruption and conflicts of interest

- Whistleblowing System

- Transaction security

- Tax transparency

- Cooperation with suppliers Focus on: Risk and ethics - check the highlights of the year!

- Corporate governance

- Application of corporate governance rules

- System of control in the process of preparing financial statements

- Audit firm auditing the financial statements

- PZU's share capital and its shareholders

- Rules for amending the Company's Articles of Association

- Shareholder Meeting and shareholder rights

- Supervisory Board and Management Board

- Compensation paid to members of supervisory and management bodies

- Diversity policy Focus on: Corporate governance - check the highlights of the year!

- Shares and bonds

- Equity and bond market

- PZU's share price

- Banking sector on the Warsaw Stock Exchange

- PZU's investor relations

- Analysts' recommendations regarding PZU's shares

- PZU Group's Capital and Dividend Policy

- Debt financing of PZU, Bank Pekao and Alior Bank

- Rating

- Calendar of PZU's major corporate events in 2021 Focus on: Shares and bonds - check the highlights of the year!

Situation on the financial markets

The COVID-19 pandemic was a key factor to determine the situation in financial markets in 2020. The outbreak and the related restrictions of business activities as well as the perspective of a strong GDP reduction, which posed the risk of a long-term limitation of the economic growth potential, contributed in the initial period to a sharp decrease of prices of risky assets, a reduction of bond yields and gold price increases. With time, however, the strong response of central banks, involving cuts of interest rates, a large-scale purchase of assets and supporting liquidity of banks to stimulate credit flow to the economy, contributed to calming the market situation. What also helped was government programs, introduced relatively soon and on a large scale, to support companies and employees affected by effects of the pandemic. Towards the end of the year, the imminent prospect of COVID-19 vaccine registration further improved investors’ moods. In 2020, a clearly increased volatility in financial markets continued.

Bond market

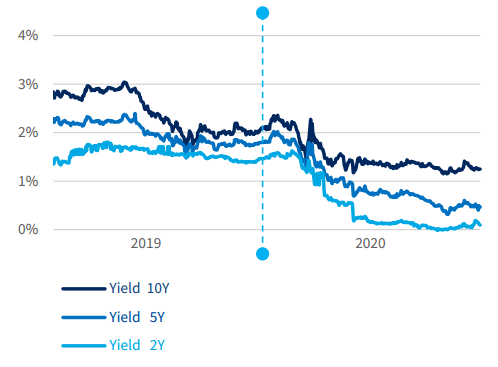

The profitability of Polish 10-year treasury bonds was 1.25% at the end of 2020 compared to 2.06% at the end of 2019 (the data after Refinitiv Datastream). This meant a decrease in the spread relative to similar German treasury bonds from 225 bps to 182 bps. This is because the yield of 10-year “Bunds” declined in the period from -0.19% to -0.575%. The decline in the bond yield in Poland began as early as in February 2020, while in April and May, it deteriorated as a result of loosening strongly the monetary policy in the situation of a strong GDP decrease. After the NBP’s reduction of interest rates in May, yields of 10-year treasury bonds only incidentally rose over 1.40%. The central banks, by buying out bonds, were able to prevent longer-term market interest rates to normalize too early so as not to make it difficult for the economy to operate during the pandemic. At the same time, the yields of one-year and two-year treasury bonds in Poland in the second half of 2020 (and especially in Q4) were periodically even close to zero.

Equity market

Although the COVID-19 pandemic had a particularly strong impact on the equity market, between the end of 2019 and the end of 2020, the WIG index lost merely 1.4% and the WIG20 index declined by 7.7% (the data after WSE). The indices that increased were those of medium (mWIG40, slightly) and small companies (sWIG80). However, during the year, share prices have fluctuated strongly, reacting in this way to information about the development of the pandemic and actions taken by governments and central banks. After the growth in the beginning of the year, both main stock market indices started to fall at the end of February, reaching the minimum on 12 March 2020, when large-scale restrictions were announced because of the COVID-19 pandemic. The WIG index slipped 35.7% and the WIG20 index fell 39.3% between the end of 2019 and 12 March 2020.

Then an upward trend appeared. Until 17 August, the WIG index rose by 42.3% and the WIG20 by 42.6%. Realizing profits and entering the period of dynamically intensifying „second wave” of the pandemic resulted in a renewed fall in stock market indices, with the turning point being the announcement of the next phase of the restrictions on 30 October 2020. Between 17 August and 30 October, the WIG index dropped 16.6% and the WIG20 index fell 18.6%. Then equity prices increased until the end of the first ten days of December, and then slightly fell in the last weeks of the year because investors realized profits. Between 30 October and 31 December 2020, the WIG index rose by 29.3% and the WIG20 by 30.9% (the data after WSE).

Treasury bond yields in 2020 (the data after Refinitiv Datastream)

WIG and WIG20 indices (the data after Warsaw Stock Exchange)

Foreign market indices behaved in a diverse manner, reflecting the course of the COVID-19 pandemic and the specific situation in each country. US indices rose very strongly between the end of 2019 and the end of 2020, e.g. S&P500 grew by 16.3% (the data after Refinitiv Datastream). What contributed to this was the outcome of the presidential election known in November 2020. The German DAX30 index increased by 3.5%. On the other hand, the British FTSE 100 lost 14.3%, due to, apart from the pandemic, the completion of the Brexit. The “emerging markets” index MSCI EM rose by nearly 16% in 2020 (the data after MSCI).

Currency market

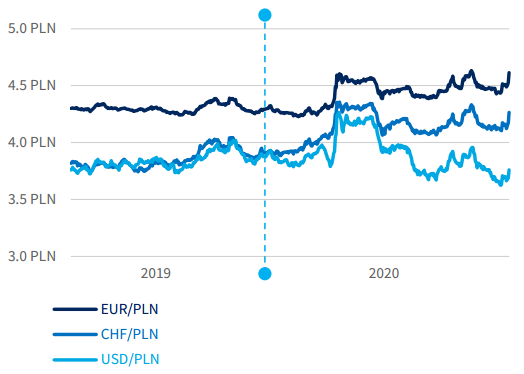

In 2020, the Polish zloty strengthened slightly relative to the US dollar and weakened relative to the euro. The EUR/PLN exchange rate increased by 8.4%, between the end of 2019 and the end of 2020, from 4.26 to 4.61 (the data after NBP). The PLN exchange rate was very volatile during the year. Since the end of February 2020, the zloty has weakened in the face of the development of the COVID-19 pandemic and later decisions to introduce restrictions and relax the monetary policy, while the EUR/PLN exchange rate remained above PLN 4.50 from 19 March to 25 May. Loosening restrictions and the economic recovery resulted then in the strengthening of the zloty. The EUR/PLN exchange rate periodically decreased, especially in the second half of August, when it fell, for a short time, slightly below the threshold of 4.40. From the end of September, the zloty became weaker again, having exceeded even the level of 4.60 at the end of October and the beginning of November. Slowing down the development of the pandemic resulted in the strengthening of the zloty to approx. 4.43–4.44 between 9 and 17 December. At the end of 2020, interventions by the NBP pushed the EUR/PLN exchange rate over 4.50 again.

What contributed to the decrease in the USD/PLN exchange rate by 1% in 2020, from 3.80 to 3.76, was the strengthening of euro against the US dollar. The EUR/USD exchange rate grew by 9% in 2020, from 1.12 to 1.22. On the other hand, the Polish zloty clearly weakened against the Swiss franc – the CHF/PLN exchange rate increased by 8.7% to 4.26.

PLN exchange rate (the data after NBP, Cental Bank of Poland)

Investor Relations Team

e-mail: IR@pzu.pl

Magdalena Komaracka, IR Director, tel. +48 (22) 582 22 93

Piotr Wiśniewski, IR Manager, tel. +48 (22) 582 26 23

Aleksandra Jakima-Moskwa, tel. +48 (22) 582 26 17

Aleksandra Dachowska, tel. +48 (22) 582 43 92

Piotr Wąsiewicz, tel. +48 (22) 582 41 95