Main trends in the Polish economy

Gross Domestic Product

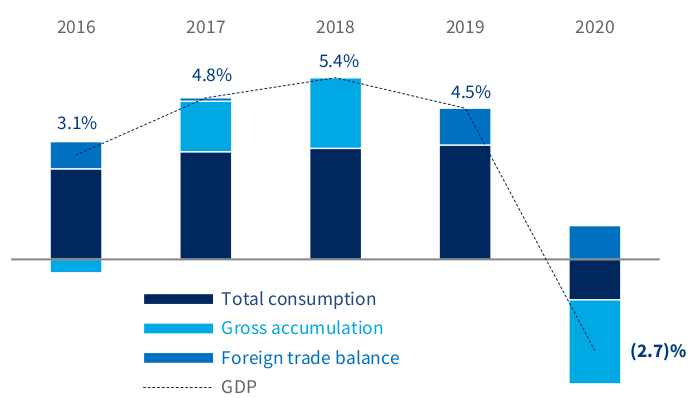

According to preliminary estimates, real GDP in 2020 declined 2.7% amidst the COVID-19 pandemic. The strongest contributing factors to this decline were slumps in household consumption (-1.7 p.p.) and gross fixed capital formation (-1.6 p.p.). Household consumption and investments dropped by 3% and 8.4%, respectively. As a consequence, in 2020, the investment rate in the national economy (the ratio of gross fixed capital formation to gross domestic product at current prices) fell to 17.1%, compared to 18.5% in 2019. The scale of decline in GDP was curtailed by net exports, which added 1.0 p.p. to its growth rate.

The restrictions on economic activity and freedom of movement imposed in March 2020 with a view to preventing the dissemination of the coronavirus translated into a decline in real GDP in Q2 2020 by as much as 8.4% y/y, following an increase by 1.9% y/y in Q1 2020. Disruptions in industrial supplies caused by the outbreak of the pandemic in China and Italy and the resumption of border controls within the European Union also exerted a negative impact on GDP in this period. In Q2 2020, private consumption plunged by as much as 10.8% y/y. Cost cuts effected by enterprises and a greater degree of uncertainty additionally suppressed investments in fixed assets, which dwindled by 10.7% y/y.

The gradual lifting of restrictions and the revival of mobility in Q3 2020 translated into an ‘automatic’ rebound in economic activity and the unclogging of delayed consumer demand, in particular for durable goods. In parallel with the restoration of international trade and the economic upturn in China, this contributed to a significant improvement across the global industrial sector in H2 2020, of which Poland was also a beneficiary. As a result, the country’s GDP in Q3 2020 increased significantly compared to Q2 2020, meaning that in annual terms the decline in this period was reduced to -1.5% y/y with a slightly positive rate of growth in private consumption (0.4% y/y). The easing of fiscal and monetary policies helped protect the country’s economic potential and reduce the unfavorable impact of the pandemic on the labor market. Compared to Q2 2020, even investments turned out to be on the rise, owing to which their negative rate of growth shrank to -9.0% y/y in this period.

The escalation of the COVID-19 pandemic in the last quarter of 2020 and the partial reinstatement of restrictions on service industries resulted in another slowdown in economic growth. However, because the economy managed to attune to operating in the conditions of a pandemic, the drop in GDP in Q4 2020 turned out to be relatively minor. According to estimates, the rate of GDP growth in Q4 2020 declined to nearly -2.8% y/y, with private consumption dropping by 3.2% y/y. Consumption is estimated to have dwindled by approx. -3.0% y/y, a rate of decline significantly smaller than that experienced in the spring. In the same period, industrial production was on a significant rise, and in October 2020 exceeded the February level, i.e. that generated before the pandemic, followed by an even greater improvement in growth rate in December of approx. 2.7%. However, the situation of service industries exposed to the highest risk of coronavirus infection, where restrictions on the conduct of business were the most severe, was significantly harsher (the data after the Central Statistical Office).

Decomposition of GDP growth in 2016-2020

Source: Statistics Poland, preliminary estimate of GDP in Q4 2020 as at 26 February 2021

Labor market and consumption

The COVID-19 pandemic caused a deterioration of the situation in the labor market in 2020, albeit to a lesser extent than was predicted in the spring when the coronavirus reached Poland. For the first time since 2012, the number of people employed in the national economy decreased, and the average headcount in the enterprise sector was 1.1% lower than in 2019. After six years of uninterrupted improvement, since April 2020, registered unemployment has bounced back up: the number of registered unemployed individuals and the registered unemployment rate have been greater than the year before.

Still, owing to government support programs, the increase in unemployment was much lower than may have been feared at the outset of the pandemic. Enterprises, by cutting their costs, made efforts to protect employment to the best of their ability. At the end of 2020, the registered unemployment rate stood at 6.2% (compared to 5.2% in December 2019, the data after the Central Statistical Office). In December 2020, the seasonally adjusted rate of economic unemployment (according to Eurostat) stood at 3.3% (compared to 2.9% in December 2019), clearly below the European Union average (7.5%) and the euro area (8.3%).

The slowdown in employee compensation growth in the enterprise sector was less severe than had been expected in the context of the decline in economic activity. The nominal average gross monthly employee compensation in the enterprise sector increased by 4.7% in 2020, compared to a rate of 6.5% in 2019. The average monthly salary across national economy in the last year increased in nominal terms by 5% (the data after the Central Statistical Office).

Due to intermittently imposed restrictions on economic activity and health concerns, which resulted in the isolation and self-limitation of consumer mobility, household consumption declined by 3.0% in 2020. The largest such decline was recorded in Q2 2020, when the restrictions were the most severe. Following a strong rebound in Q3, consumption dwindled again in the concluding months of the year. However, due to the adjustments made by companies enabling them to operate in the conditions of the COVID-19 pandemic, the scale of this decline was significantly smaller. Another consequence of the pandemic was an increase in household savings in 2020.

Inflation, monetary policy and interest rates

In 2020, the consumer price index (CPI) increased on average by 3.4% in annual average terms, compared to 2.3% in 2019. Accordingly, the shock caused by the COVID-19 pandemic did not suppress the rate of inflation. On the contrary, the prices of services increased significantly (by 6.9% y/y compared to 3.9% y/y in 2019), largely due to an increase in costs resulting from the need to abide by the requirements associated with efforts aimed at counteracting the pandemic. Commodity prices increased by 2.1% compared to 1.7% in 2019. Net core inflation (CPI without food and energy prices) was 3.9% in 2020, compared to 2% in 2019. In 2020, food and energy prices increased 4.7% and 4.9%, respectively, while fuel prices dropped by 10.4%, suppressing the overall growth in the price index (the data after Central Statistical Office and National Bank of Poland).

Starting in mid-March 2020, the Monetary Policy Council took a number of steps to support the economy in the face of the COVID-19 pandemic. It effected three cuts of the NBP basic interest rate – to 1% in March, to 0.5% in April and to 0.1% in May. The Monetary Policy Council also lowered the reserve requirement for banks and carried out a bond purchase program through structural open market operations. Moreover, it introduced a promissory note loan program under which banks may obtain cheap refinancing of loans granted to commercial undertakings.

Public finance

As was the case in other countries, the COVID-19 pandemic and the measures taken by the government to minimize its effects resulted in an increase in the deficit of the public finance sector. According to the European Commission’s forecasts of November 2020, the deficit of the general government sector in Poland might increase to 8.8% of GDP in 2020, while public debt (as defined by the European Union) might increase to 56.6% of GDP. In 2020, Poland did not experience any problems with obtaining market financing. According to the Ministry of Finance’s estimates, at the end of the year, approx. than 36% of the country’s borrowing needs planned for 2021 were prefinanced.